It’s unlikely too many people will sell the next 2 weeks as they would like to defer their taxes to next year. That bodes well for the markets to at worst stay where they are if not continue their climb up.

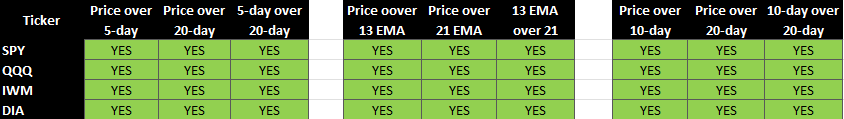

No matter which may we look at the trending from a short-term perspective, it is all green as we can see from the picture above.

Yes, the markets are certainly overbought. But no one really knows when that starts to play out in a pullback. The only way to know is when the pullback actually happens. I know this very well and still got burned a little recently by anticipating the pullback which never came. Thankfully, it was a short position and no harm done.

From a longer-term perspective, as of yesterday’s close:

There are 454 S&P 500 stocks out of the 500 whose price is above their 50-day SMA.

There are 374 S&P 500 stocks out of the 500 whose price is above their 200-day SMA.

So, there is currently strong broad-based bullishness among the top 500 stocks.

The numbers for the Russell 2000 small cap index also look good.

There are 1557 Russell 2000 stocks out of 2000 whose price is above their 50-day SMA.

There are 1161 Russell 2000 stocks whose price is above their 200-day SMA.

I am going to keep taking actions based on what the markets do and not what market participants expect the market to do.

From a very high-level valuation perspective, the market seems to be valued fairly. The earnings for the S&P 500 are expected to be $245 for 2024. Using yesterday’s close of 4768 for the S&P 500, we arrive at a PE multiple of 19.46. The question will be how accurate the $245 number turns out to be and, as we move into 2024, what are the prospects for 2025 earnings. More on this in another note.