Major Markets Trending Review

Experts can find several reasons for why the markets turned around on Friday. The same experts would have found several reasons for the markets going down as well. My point is that no one knows what really is going to happen and that the reasons for what happened do not matter.

On Tuesday I wrote about how to start nibbling when there is a potential near-term bottom. Following the very short-term trend paid off this time for me. There is no reason (yet) why I should change anything for now. Monday trading may tell me to change my approach. But it will be solely based on price action and not on any expert view or opinions based on fear or greed.

I wanted to go deeper into my approach today. So, just covering the major markets in this note in more detail.

Short-Term Trending

I started nibbling because of the short-term price trending which currently looks like this. It is based on the hourly trends.

I update the above table every day after market close. This is fast moving trending and can change quite a lot over a single day because a single day has 7 candles (for the 6.5 hours of trading). This trending analysis is good for short-term trading (several hours to a few days). If the short-term trending is also aligned with the mid and/or long-term trending, then the trade period can be longer.

Note that I do not take profits/losses at a certain level for the trades that I make. I close out positions (either way) when the trend is reversing or has reversed. I do not set price targets or stop loss. I set alerts for my trends and use that to decide my actions.

Mid-Term Trending

This is the most commonly used chart period - the daily chart. This is slower moving than the hourly charts and can be used to trade for positions held anywhere between several days to a few weeks.

We can see that the markets are just starting to reverse from their bearish trending with the QQQ leading the way. This tells me whether the short-term trend has any strength or just a little breather before price keeps sinking again. So far so good but we are not in the clear. We will need to see follow-through next week to confirm the reversal.

It is quite possible that the short-term trend reversal was just that - a very short-term trend reversal. We can go back to the downward trending that we were in. When the trending changes I will change my mind.

Note that so far, I have been nibbling (taking very small, long positions). If the mid-term trending continues to improve, I will start taking bigger positions.

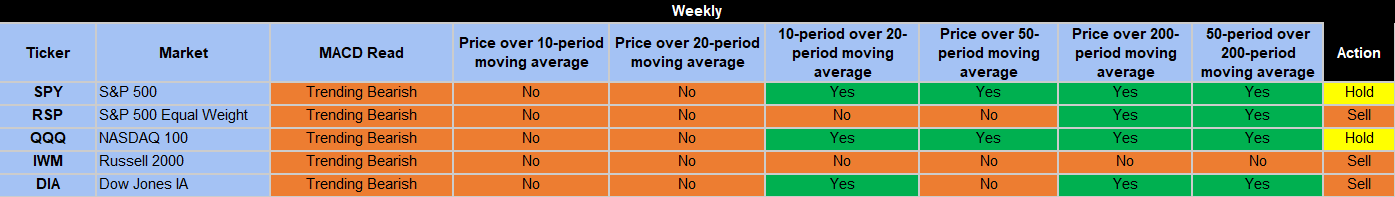

Long-Term Trending

The longer-term trending patterns are just now giving the warnings and telling us to get out of the markets. This is happening when the markets were already down between -7% and more. This is good for long-term traders because they do not sell or reverse their positions on anything that is not a confirmed reversal.

Strategy

I will continue to hold my long positions if the short-term trend continues. If it changes, I will liquidate. If the mid-term trend continues to improve, I will add to my long positions. I will stay disciplined and keep it simple.