The Magnificent 7 Big Tech stocks have been the leaders all year long and continue to lead the markets in recent bull run as well. Most of them are close to their 52-week high except TSLA. All of them are up huge from their 52-week lows.

Let’s take a look at their current trending. After all, we want to check whether there is a good potential for them in the near future and beyond. Not just gloat on their gains to date.

Here is the trending based on daily chart.

The picture above looks close to perfect. Are the stocks also priced to perfection? I do not know. All I know is that markets are somewhat cyclical and when there is a lot of greed in the market participants, the top has been near. But I do not go by what may happen. I go by what is happening. So, I will not place new money at these levels but will also not short them here.

Note that I use FNGS as a proxy for the Big Tech stocks that includes the Magnificent 7. Other than the 7 listed here, the FNGS also has NFLX, AVGO and SNOW. All the 10 holdings are equal-weighted, and this instrument provides a good average of the Big Tech sector.

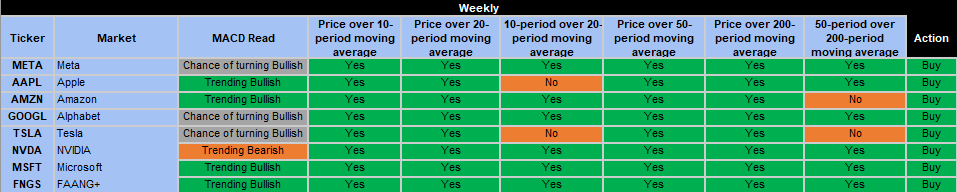

Here is the trending based on weekly chart.

A very similar picture as the one for the daily charts. Again, looks almost perfect.

All of the above have their AI plays and as we know AI has been a big theme this year. From the current expectations of AI driven growth, the stock prices seem reasonable. The hiccup comes in if there is any indication that AI promises are not going to pan out as expected. And NVDA price movement and behavior should tell us that.

I usually play these stocks directly only for short-term trading and that too mostly on the long side. It is dangerous to short them. But if I see that there is weakness creeping up, I will play the QQQ and FNGS to the short side.