Bullish Trending Markets facing Earnings Season

The earnings season is upon us and will hog the news for the next few weeks. We got a taste from the big banks Friday morning with indications that they are being cautious for this year. Interestingly though, the stock price of the banks at first fell but then recovered to close Friday positive.

More important to me is the fact that the S&P 500 is sitting at a very critical point on a long-standing downward trendline. This is what I will be watching the coming week. More on that later in the note.

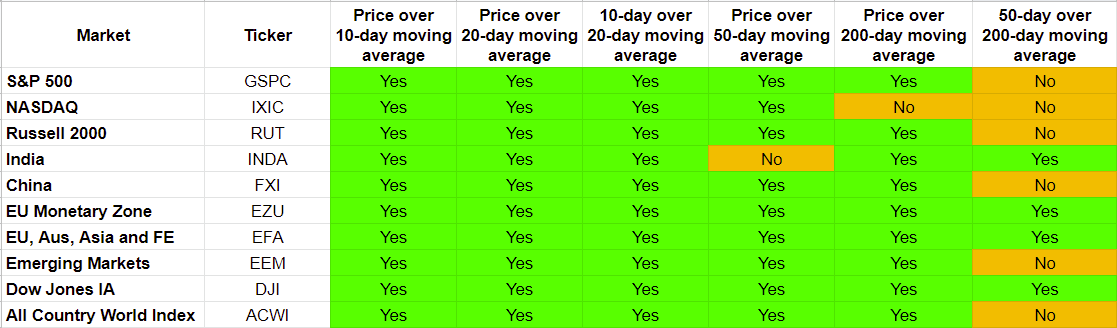

Let’s start with the major markets trending:

The S&P 500 has turned short-term bullish, and the price has also crossed over the 50-day and the 200-day moving averages.

The NASDAQ has turned short-term bullish, and the price has crossed over the 50-day moving average.

The Russell 2000 has turned short-term bullish, and the price has also crossed over the 50-day and the 200-day moving averages.

India has turned short-term bullish, and the price has crossed over the 200-day moving average. Plus, the 50-day moving average is above the 200-day moving average. However, the price is still below the 50-day moving average. This one has a strange situation, and I will review closely to determine what the probabilities tell me.

China continues to trend short-term bullish. No change in trending this week.

The EU Monetary Zone EZU and the EU, Australia, Asia and Far East EFA continue to trend perfectly bullish.

The Emerging Markets EEM continues to trend short-term bullish.

The Dow Jones Industrial Average turned short-term bullish making it trend perfectly bullish.

The All-Country-World-Index ACWI turned short-term bullish.

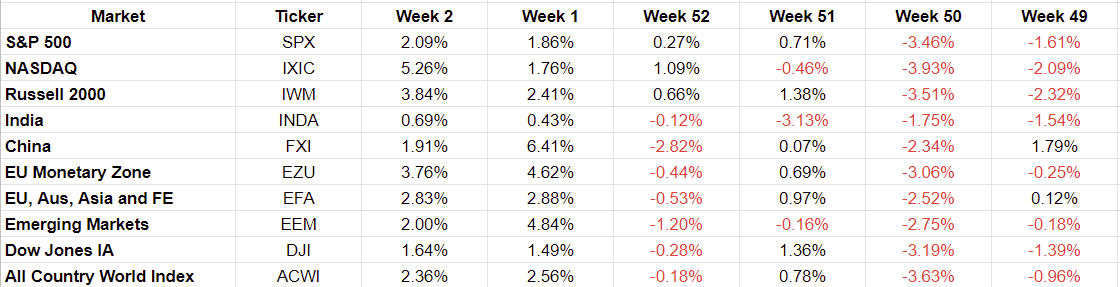

Here are the performance over different periods:

The Global Markets - China, Europe and Emerging Markets - continue to outperform the US markets. Before we think of jumping away from the US markets onto the Global Markets, we should be aware that markets have a way of catching up to leaders. So, it is quite possible that the US markets perform better the next few weeks.

Here is the week-over-week performance:

The S&P 500, NASDAQ and the Russell 2000 have had 3 straight weeks of positive returns. I do not predict whether it will be positive 4 weeks in a row. Over the last year, the returns have been fluctuating up and down quite a bit with high volatility.

There is good news in the volatility side after a long time. It is the lowest it has been over a year at 18.35.

The SPX chart is in an interesting point. The price is sitting exactly and downward trend line we have over the last year. This will be the 6th attempt at piercing through that well defined trend. Each of the previous 5 times price has failed and retraced back. The last attempt was a quick one and this one is also a quick one - both without going through lower lows. And with the volatility down substantially, one can be hopeful this time.

Conclusions:

The current trending in the markets is quite strong to the bullish side. We have seen this type of trending several times over the last year with eventually price breaking down and failing. This time could be different.

The volatility has come down dramatically and sitting at 1-year lows. This is somewhat supporting the bull case. In prior attempts we have not seen that.

The SPX price is sitting on the downward trendline, and I think there is a higher probability this time the price pierces through this to the upside.

My general expectation is price to continue to the upside. But I will be ready to take action whatever happens. I do not forecast or make predictions. I follow the trend and take actions based on those trends.