Big Tech Assessment

As we can see most stock markets are turning. We looked at the major markets yesterday and some alternate sectors earlier today. We found the following have already reversed and are currently trending bullish:

Emerging Markets EEM

Energy XLE

Materials XLB

Utilities XLU (I am long call options)

Healthcare XLV (I am long call options)

Semiconductors XSD

Several individual countries are trending bullish as well - Australia, Canada, Germany, Hong Kong, Japan, UK, Brazil, China, and South Korea.

Then, among the alternate sectors the following are trending bullish:

Natural Gas UNG

Lithium LIT

Solar Energy TAN

Clean Energy ICLN

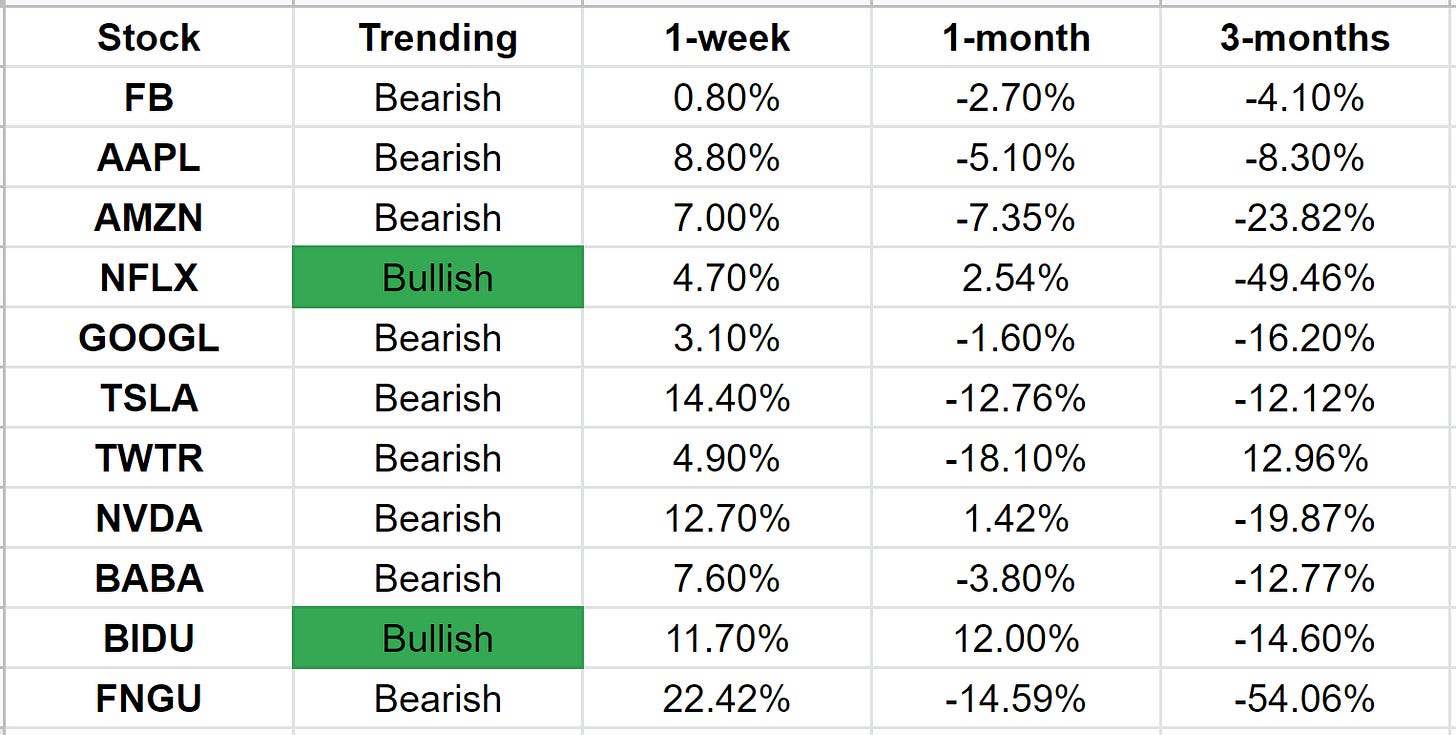

Now I want to look at Big Tech companies and to do that I use FNGU and BULZ. First FNGU:

And this is BULZ:

Note 7 of the Big Tech stocks are common between FNGU and BULZ. And so far, we see that only 4 out of the 18 stocks are trending bullish. However, all of them had nice gains last week.

So, the conclusion from all the assessment is that last week could have been the start of the reversal. It is time to keep getting in the markets slowly.

Tomorrow, I do intend to make some purchases from the ones I have identified.