Another Boring Note on Stock Markets

I would rather be boring than lose money. I do not invest or trade individual stocks because of their higher levels of uncertainty. I do have conviction in many individual stocks that they will continue to do well. Specially in the technology space I know that Nvidia, Microsoft, Google, Apple, Tesla, etc. will continue to do well and keep increasing their earnings. But that does not mean the stock will always do well and make me money. There are higher levels of uncertainties that can play an outsize role in the stock performance.

The S&P 500 has lost -18.9% year-to-date. The NASDAQ has lost -26.8%. And Nvidia has lost -46.4%. The earnings growth rate for Nvidia is still projected to be +34%. So, why has it underperformed the markets? There could be many reasons and I may know the reason. But knowing the reason does not help as I would have lost more money (double the money) if I had held on to the stock. Similarly, Tesla is down -40% year-to-date. Yet, it still has stellar earnings growth projections of +51%.

So, here is another boring note.

Major Markets

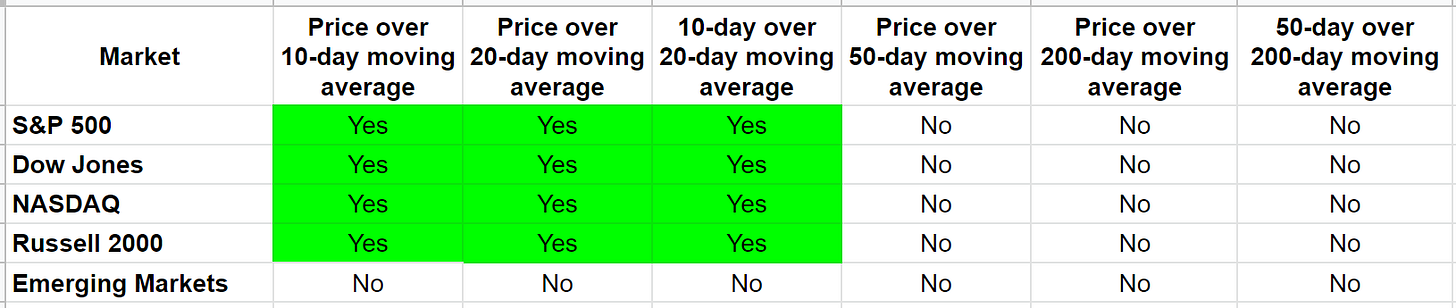

Starting with the major markets.

The Friday strength in the markets ensured that the bullish trend per my system remained intact at least for now. All the major markets except for the Emerging Markets remain short-term bullish. The S&P 500 has gained +5% over the trailing 1-month period.

Major Sectors

This is how the major sectors look like per my system.

The Financials and Transports turned bullish. The Healthcare, Consumers, Technology, Homebuilders and Biotech remained bullish. Overall, these are the primary sectors that make up the S&P 500 and they look for now.

So, I continue to have conviction that the markets move higher from here at least for the short-term. Accordingly, I will continue to hold my positions for now and see what the markets tell me to do next.