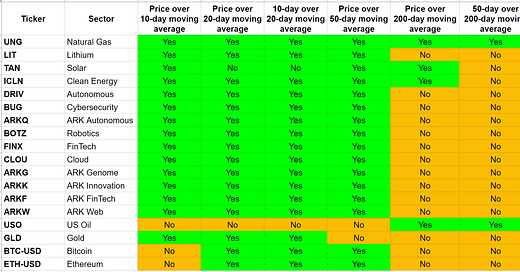

Alternate Sectors Trending Report

The major stock markets continue to trend higher. Both the S&P 500 and the NASDAQ prices are trading higher than their 50-day moving averages. Next step in the ladder is the 200-day moving average which may be broken soon.

Looking at the Alternate sectors of the stock markets and noting the changes from last analysis.

Lithium (LIT) is now trending short-term bullish. It is up +12% over 3 months.

Solar (TAN) is trending short-term bullish. It is up +21% over 3 months. Also, the price has now crossed over the 200-day moving average.

Clean Energy (ICLN) continues to trend short-term bullish. Also, the price has now crossed over the 200-day moving average.

Autonomous Driving (DRIV) continues to trend short-term bullish. Also, the price has crossed over the 50-day moving average.

Cybersecurity (BOTZ) is now trending short-term bullish. Although it is down -3% over 3 months.

Cloud (CLOU) is trending short-term bullish. Although it is down -5% over 3 months.

Gold (GLD) is now trending short-term bullish. It is down -5% over 3 months.

Bitcoin (BTC-USD) continues to trend short-term bullish. However, the price has dipped below the 10-day moving average. It is down -42% over 3 months.

Ethereum (ETH-USD) continues to trend short-term bullish. However, the price has dipped below the 10-day moving average. It is down -45% over 3 months.

So, we can see that mostly all continue to trend bullish along-with the markets. Oil continues to trend opposite of the markets. Bitcoin and Ethereum need to pick up the pace if they are going to maintain their short-term bullish trending.